In the past half of 2021, under various policy factors, the oil coke carburizer is bearing the double factor of raw material cost and demand weakening. Raw material prices rose more than 50%, part of the screening plant was forced to suspend business, carburizer market is struggling.

-

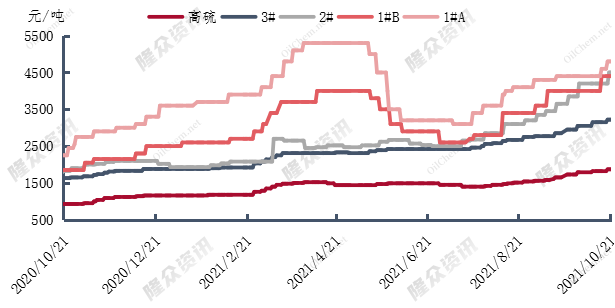

National mainstream models of petroleum coke price trend chart

According to statistics, from the end of May, the domestic petroleum coke price showed an upward trend, especially from August to now, the increase is particularly rapid. Among them, the market price of 1#A is 5000 yuan/ton, up 1900 yuan/ton or 61.29%. 1#B market price 4700 yuan/ton, up 2000 yuan/ton or 74.07%. 2# coke market price 4500 yuan/ton, up 1980 yuan/ton or 78.57%. Raw material prices rise, driving carburizer prices.

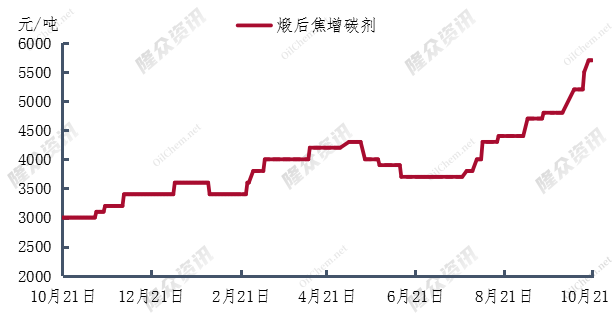

After calcination coke carburizing agent market mainstream price 5500 yuan/ton (particle size: 1-5mm, C: 98%, S≤0.5%), 1800 yuan/ton or 48.64% higher than earlier. Raw material price market actively push up, the purchase cost increases suddenly, calcined coke carburizer manufacturers wait and see atmosphere strong, cautious market. Market transaction in general, manufacturers bearish sentiment is obvious. Some enterprises due to high cost, reduce screening material or directly shut down, the resumption of production time is uncertain.

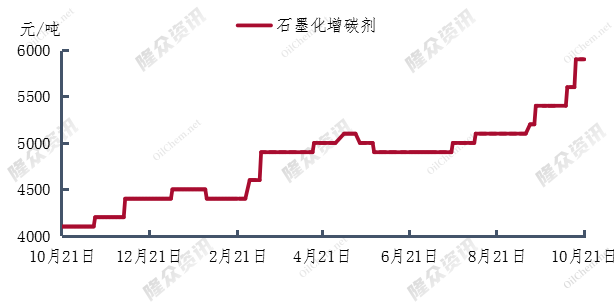

Graphitization carburizer market mainstream price 5900 yuan/ton (particle size: 1-5mm, C: 98.5%, S≤0.05%), 1000 yuan/ton or 20.41% higher than the previous. Graphitization carburizer price increase rate is relatively slow, individual enterprises processing anode materials, earn processing fees. Some downstream enterprises give up calcined carburizer to adopt semi-graphitized carburizer, driving the price of carburizer up.

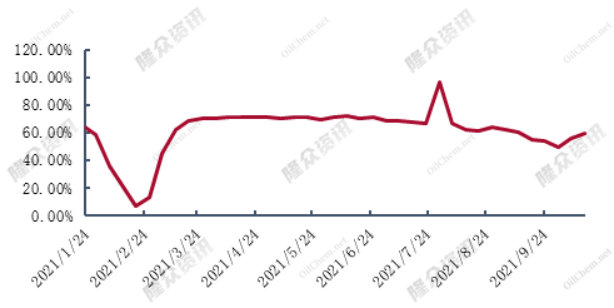

At present, the field terminal demand release rhythm fluctuation is still large, the overall market transaction is weak. Recently, due to the cold weather in the northern region, the construction has slowed down, while the southern region is still suitable for the construction season. Some cities in East and South China have reported the out-of-stock situation of specifications, and the out-of-stock specifications are mainly large specifications, while the actual demand at the end still exists. With the gradual advance of time, terminal demand will still have a large probability of good performance.

Raw material prices continue to pull up, to provide cost support for the recarburizer, but the downstream demand needs time, in the short term, the high power to push up. Part of screening plants have temporarily suspended production, short-term supply may not be able to improve. It is expected that the oil coke carburizer market price will continue to follow the raw material cost strong operation.

Post time: Oct-29-2021