Abstract: the author analyzes the needle coke production and consumption situation in our country, the prospect of its application in graphite electrode and negative electrode materials industry prospect, to study the oil needle coke development challenges, including the raw material resources are in short supply, the quality is not high, long cycle and overcapacity application evaluation, increase the product segmentation research, application, performance measures, such as association studies to develop high-end market.

According to the different sources of raw materials, needle coke can be divided into oil needle coke and coal needle coke. Oil needle coke is mainly made from FCC slurry through refining, hydrodesulfurization, delayed coking and calcination. The process is relatively complex and has high technical content. Needle coke has the characteristics of high carbon, low sulfur, low nitrogen, low ash and so on, and has outstanding electrochemical and mechanical properties after graphitization. It is a kind of anisotropic high-end carbon material with easy graphitization.

Needle coke is mainly used for ultra high power graphite electrode, and lithium ion battery cathode materials, as the “carbon peak”, “carbon neutral” strategic objectives, countries continue to promote the iron and steel and auto industry transformation and upgrading of industrial structure adjustment and promote the application of energy saving low carbon and green environmental protection technology, to promote the electric arc furnace steelmaking and the rapid development of new energy vehicles, The demand for raw needle coke is also growing rapidly. In the future, the downstream industry of needle coke will still be highly prosperous. This topic analyzes the application status and prospect of needle coke in graphite electrode and anode material, and puts forward the challenges and countermeasures for the healthy development of needle coke industry.

1. Analysis of production and flow direction of needle coke

1.1 Production of needle coke

The production of needle coke is mainly concentrated in a few countries such as China, the United States, The United Kingdom, South Korea and Japan. In 2011, the global production capacity of needle coke was about 1200kt/a, of which China’s production capacity was 250kt/a, and there were only four Chinese needle coke manufacturers. By 2021, according to the statistics of Sinfern Information, the global production capacity of needle coke will increase to about 3250kt/a, and the production capacity of Needle coke in China will increase to about 2240kt/a, accounting for 68.9% of the global production capacity, and the number of Chinese needle coke manufacturers will increase to 21.

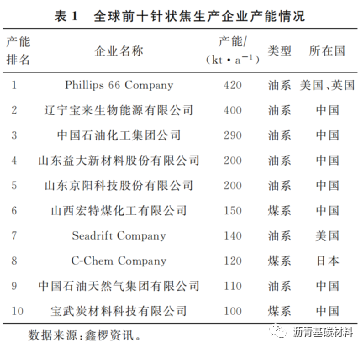

Table 1 shows the production capacity of the top 10 needle coke manufacturers in the world, with a total production capacity of 2130kt/a, accounting for 65.5% of the global production capacity. From the perspective of global production capacity of needle coke enterprises, oil series needle coke manufacturers generally have a relatively large scale, the average production capacity of a single plant is 100 ~ 200kt/a, coal series needle coke production capacity is only about 50kT /a.

In the next few years, the global needle coke production capacity will continue to increase, but mainly from China. China’s planned and under construction needle coke production capacity is about 430kT /a, and the overcapacity situation is further aggravated. Outside China, the needle coke capacity is basically stable, with Russia’s OMSK refinery planning to build a 38kt/a needle coke unit in 2021.

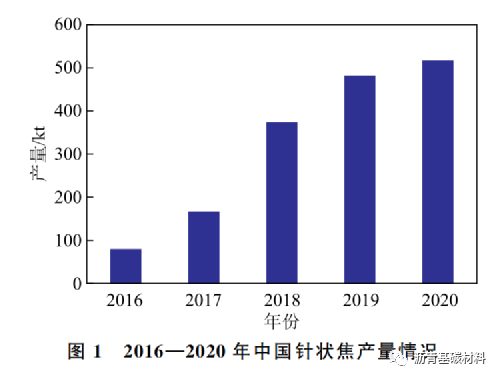

Figure 1 shows the production of needle coke in China in recent 5 years. As can be seen from Figure 1, needle coke production in China has achieved explosive growth, with a compound annual growth rate of 45% in 5 years. In 2020, the total production of needle coke in China reached 517kT, including 176kT of coal series and 341kT of oil series.

1.2 Import of needle coke

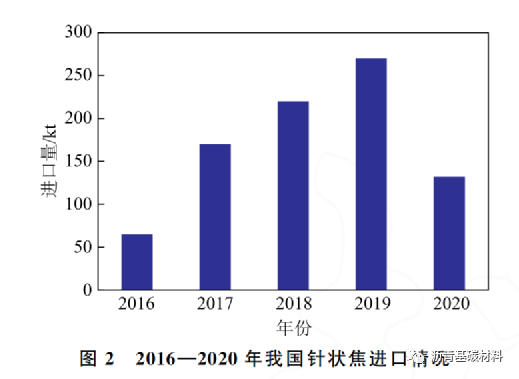

Figure 2 shows the import situation of needle coke in China in recent 5 years. As can be seen from Figure 2, before the COVID-19 outbreak, the import volume of needle coke in China increased significantly, reaching 270kT in 2019, a record high. In 2020, due to the high price of imported needle coke, decreased competitiveness, large port inventory, and superimposed by the continuous outbreak of epidemics in Europe and the United States, China’s import volume of needle coke in 2020 was only 132kt, down 51% year on year. According to statistics, in the needle coke imported in 2020, oil needle coke was 27.5kT, down 82.93% year on year; Coal measure needle coke 104.1kt, 18.26% more than last year, the main reason is that the maritime transportation of Japan and South Korea is less affected by the epidemic, secondly, the price of some products from Japan and South Korea is lower than that of similar products in China, and the downstream order volume is large.

1.3 Application direction of needle coke

Needle coke is a kind of high-end carbon material, which is mainly used as raw material for the production of ultra-high power graphite electrode and artificial graphite anode materials. The most important terminal application fields are electric arc furnace steelmaking and power batteries for new energy vehicles.

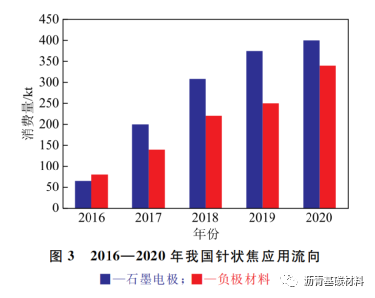

FIG. 3 shows the application trend of needle coke in China in recent 5 years. Graphite electrode is the largest application field, and the growth rate of demand enters a relatively flat stage, while negative electrode materials continue to grow rapidly. In 2020, the total consumption of needle coke in China (including inventory consumption) was 740kT, of which 340kT of negative material and 400kt of graphite electrode were consumed, accounting for 45% of the consumption of negative material.

2.1 Development of eAF steelmaking

The iron and steel industry is a major producer of carbon emissions in China. There are two main production methods of iron and steel: blast furnace and electric arc furnace. Among them, electric arc furnace steelmaking can reduce carbon emissions by 60%, and can realize recycling of scrap steel resources and reduce dependence on iron ore import. The iron and steel industry proposed to take the lead in achieving the goal of “carbon peak” and “carbon neutrality” by 2025. Under the guidance of the national iron and steel industry policy, there will be a large number of steel plants to replace converter and blast furnace steel with electric arc furnace.

In 2020, China’s crude steel output is 1054.4mt, of which the output of eAF steel is about 96Mt, accounting for only 9.1% of the total crude steel, compared with 18% of the world average, 67% of the United States, 39% of the European Union, and 22% of Japan’s EAF steel, there is great room for progress. According to the draft of “Guidance on Promoting high-quality Development of Iron and Steel Industry” issued by the Ministry of Industry and Information Technology on December 31, 2020, the proportion of eAF steel output in total crude steel output should be increased to 15% ~ 20% by 2025. The increase of eAF steel production will significantly increase the demand for ultra-high power graphite electrodes. The development trend of domestic electric arc furnace is high-end and large-scale, which puts forward a greater demand for large specification and ultra-high power graphite electrode.

2.2 Production status of graphite electrode

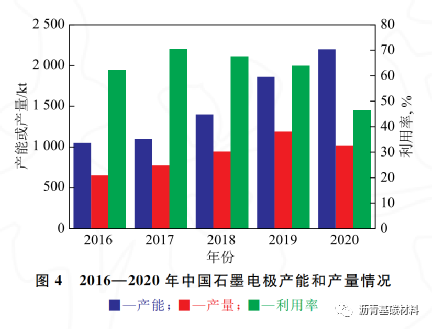

Graphite electrode is an essential consumable for eAF steelmaking. Figure 4 shows the production capacity and output of graphite electrode in China in recent 5 years. The production capacity of graphite electrode has increased from 1050kT /a in 2016 to 2200kt/a in 2020, with a compound annual growth rate of 15.94%. These five years are the period of rapid growth of graphite electrode production capacity, and also the running cycle of rapid development of graphite electrode industry. Before 2017, the graphite electrode industry as a traditional manufacturing industry with high energy consumption and high pollution, large domestic graphite electrode enterprises reduce production, small and medium-sized graphite electrode enterprises face closure, and even the international electrode giants have to stop production, resell and exit. In 2017, influenced and driven by the national administrative policy of compulsory elimination of “floor bar steel”, the price of graphite electrode in China rose sharply. Stimulated by excess profits, the graphite electrode market ushered in a wave of capacity resumption and expansion.

In 2019, the output of graphite electrode in China reached a new high in recent years, reaching 1189kT. In 2020, the output of graphite electrode decreased to 1020kT due to the weakened demand caused by the epidemic. But on the whole, China’s graphite electrode industry has serious overcapacity, and the utilization rate decreased from 70% in 2017 to 46% in 2020, a new low capacity utilization rate.

2.3 Demand analysis of needle coke in graphite electrode industry

The development of eAF steel will drive the demand for ultra-high power graphite electrode. It is estimated that the demand for graphite electrode will be about 1300kt in 2025, and the demand for raw needle coke will be about 450kT. Because in the production of large size and ultra-high power graphite electrode and joint, oil-based needle coke is better than coal-based needle coke, the proportion of graphite electrode’s demand for oil-based needle coke will be further increased, occupying the market space of coal-based needle coke.

Post time: Mar-23-2022