China’s market economy will grow steadily in 2021. Industrial production will drive the demand for bulk raw materials. The automotive, infrastructure and other industries will maintain good demand for electrolytic aluminum and steel. The demand side will form an effective and favorable support for the petcoke market.

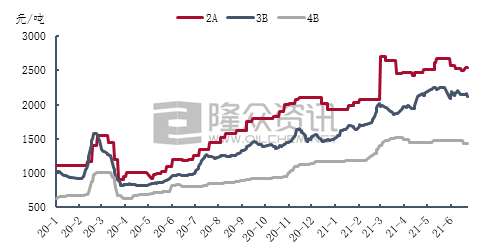

In the first half of the year, the domestic petcoke market was trading well, and the price of medium and high-sulfur petcoke showed an upward trend in fluctuations. From January to May, due to tight supply and strong demand, coke prices continued to rise sharply. In June, the price of coke began to rise with the supply, and some coke prices fell, but the overall market price still far exceeded the same period last year.

The overall market turnover in the first quarter was good. Supported by the demand-side market around the Spring Festival, the price of petroleum coke showed a rising trend. Since late March, the price of mid- and high-sulfur coke in the early period has risen to a high level, and downstream receiving operations have slowed down, and coke prices in some refineries have fallen. As the domestic petcoke maintenance was concentrated in the second quarter, the supply of petcoke declined significantly, but the demand side performance was acceptable, which is still a good support for the petcoke market. However, since June began to resume production with the overhaul of the refinery, the electrolytic aluminum in North and Southwest China frequently exposed bad news. In addition, the shortage of funds in the intermediate carbon industry and the bearish attitude to the market restricted the purchasing rhythm of downstream companies. The coke market has once again entered the consolidation stage.

According to data analysis of Longzhong Information, the average price of 2A petroleum coke is 2653 yuan/ton, a year-on-year average price increase of 1388 yuan/ton in the first half of 2021, an increase of 109.72%. At the end of March, coke prices rose to a high of 2,700 yuan/ton in the first half of the year, a year-on-year increase of 184.21%. The price of 3B petroleum coke was significantly affected by the centralized maintenance of refineries. The price of coke continued to rise in the second quarter. In mid-May, the price of coke rose to a high of 2370 yuan/ton in the first half of the year, a year-on-year increase of 111.48%. The high-sulfur coke market is still trading, with the average price in the first half of the year being 1455 yuan/ton, an increase of 93.23% year-on-year.

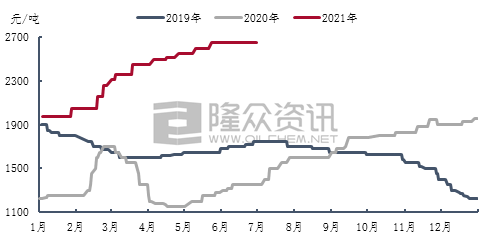

Driven by the price of raw materials, the domestic sulphur calcined coke price in the first half of 2021 showed a step-up trend. The overall trading of the calcining market was relatively good, and the demand-side procurement was stable, which is favorable for the shipment of calcined enterprises.

According to data analysis of Longzhong Information, in the first half of 2021, the average price of sulphur calcined coke was 2,213 yuan/ton, an increase of 880 yuan/ton compared to the first half of 2020, an increase of 66.02%. In the first quarter, the overall high-sulfur market was well traded. In the first quarter, the general cargo calcined coke with a sulfur content of 3.0% was raised by 600 yuan/ton, and the average price was 2187 yuan/ton. The sulphur content of 3.0% vanadium content of 300PM calcined coke has increased by 480 yuan/ton, with an average price of 2370 yuan/ton. In the second quarter, the supply of medium and high-sulfur petroleum coke in China decreased and the price of coke continued to rise. However, downstream carbon companies have limited purchasing enthusiasm. As an intermediate link in the carbon market, calcining companies have little say in the middle of the carbon market. Production profits continue to decline, cost pressures continue to increase, and calcined coke prices push up The rate of increase slowed down. As of June, with the recovery of domestic medium and high-sulfur coke supply, the price of some coke fell along with it, and the profit of calcining enterprises turned into a profit. The transaction price of general cargo calcined coke with a sulfur content of 3% was adjusted to 2,650 yuan/ton, and a sulfur content of 3.0% and vanadium content was 300PM. The transaction price of calcined coke rose to 2,950 yuan/ton.

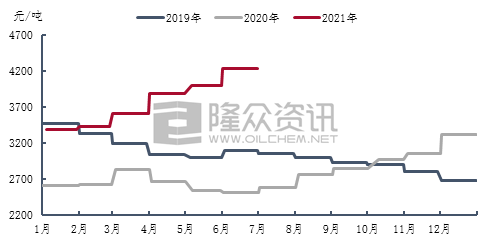

In 2021, the domestic price of pre-baked anodes will continue to rise, with a cumulative increase of 910 yuan/ton from January to June. As of June, the benchmark purchase price of pre-baked anodes in Shandong has risen to 4225 yuan/ton. As raw material prices continue to rise, the production pressure of pre-baked anode companies has increased. In May, the price of coal tar pitch has risen sharply. Supported by costs, the price of pre-baked anodes has risen sharply. In June, as the delivery price of coal tar pitch fell, the price of petroleum coke was partially adjusted, and the production profit of pre-baked anode enterprises rebounded.

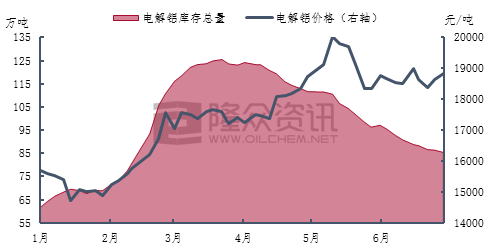

Since 2021, the domestic electrolytic aluminum industry has maintained a trend of high prices and high profits. The profit per ton of electrolytic aluminum price can reach up to 5000 yuan/ton, and the domestic electrolytic aluminum production capacity utilization rate was once maintained at around 90%. Since June, the overall start of the electrolytic aluminum industry has declined slightly. Yunnan, Inner Mongolia, and Guizhou have successively increased the control of high-energy-consuming industries such as electrolytic aluminum. In addition, the situation of electrolytic aluminum destocking has continued to increase. As of the end of June, domestic electrolytic aluminum inventory Reduced to about 850,000 tons.

According to data from Longzhong Information, the domestic electrolytic aluminum output in the first half of 2021 was approximately 19.35 million tons, an increase of 1.17 million tons or 6.4% year-on-year. In the first half of the year, the average domestic spot aluminum price in Shanghai was 17,454 yuan/ton, an increase of 4,210 yuan/ton, or 31.79%. The electrolytic aluminum market price continued to fluctuate upward from January to May. In mid-May, the spot aluminum price in Shanghai rose sharply to 20,030 yuan/ton, reaching the high point of the electrolytic aluminum price in the first half of the year, rising by 7,020 yuan/ton year-on-year, an increase of 53.96%.

Outlook forecast:

There are still maintenance plans for some domestic refineries in the second half of the year, but as the pre-maintenance of the refineries started to produce coke, the overall domestic petcoke supply has little impact. Downstream carbon companies have started relatively stably, and the terminal electrolytic aluminum market may increase production and resume production capacity. However, due to the dual-carbon target control, the output growth rate is expected to be limited. Even when the country dumps reserves to ease supply pressure, the price of electrolytic aluminum still maintains a trend of high fluctuations. At present, electrolytic aluminum enterprises are profitable, and the terminal still has certain favorable support for the petcoke market.

It is expected that in the second half of the year, due to the influence of both supply and demand, some coke prices may be adjusted slightly, but overall, domestic medium and high-sulfur petroleum coke prices are still running at a high level.

Post time: Jul-23-2021