Recently, supported by downstream industry demand, domestic petcoke spot prices ushered in the second surge in the year. On the supply side, petcoke imports were small in September, the supply of domestic petcoke resources recovered less than expected, and the recent refining of petroleum coke sulfur content On the high side, low-sulfur petroleum coke resources are seriously scarce.

Recently, supported by downstream industry demand, the domestic spot price of petcoke ushered in a sharp increase for the second time this year. On the supply side, the import volume of petroleum coke in September was small, and the supply of domestic petroleum coke resources was not recovered as expected. In addition, the sulfur content of petroleum coke in recent refining was relatively high, and low-sulfur petroleum coke resources were severely lacking. On the demand side, the demand for carbon for aluminum is strong, and winter reserves in the western region have been opened one after another. The field of anode materials has played a strong support for the demand for low-sulfur petroleum coke, and more and more low-sulfur petroleum coke resources have flowed into artificial graphite enterprises.

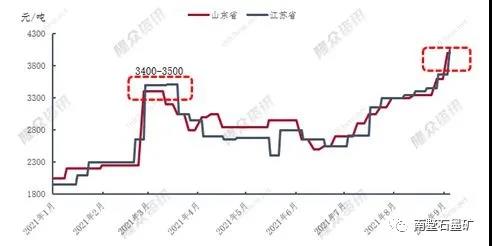

Low-sulfur petroleum coke price chart in East China in 2021

Judging from the price trend of low-sulfur petroleum coke in Shandong and Jiangsu, the price at the beginning of 2021 will be 1950-2050 yuan/ton. In March, due to the dual effects of the decline in domestic petcoke supply and the increasing downstream demand, domestic petcoke prices continued to rise sharply. In particular, low-sulfur coke faced some corporate overhauls. The price soared to RMB 3,400-3500/ton, hitting a record. A record 51% increase in a single day. Since the second half of the year, prices have gradually increased under the support of demand in the fields of aluminum carbon and steel carbon (carburizers, ordinary power graphite electrodes). Since August, due to the successive surges in low-sulfur petroleum coke prices in Northeast China, the demand for low-sulfur petroleum coke in the field of anode materials has shifted to East China, which has accelerated the rate of increase in low-sulfur petroleum coke prices in East China to a certain extent. As of this week, the price of low-sulfur petroleum coke in Shandong and Jiangsu has risen to more than 4,000 yuan/ton, a record high, which is an increase of 1950-2100 yuan/ton, or more than 100%, from the beginning of the year.

Distribution map of the downstream areas of high-quality low-sulfur coke in East China

As can be seen from the above figure, as of this week, in terms of the distribution of petroleum coke downstream demand in Shandong and Jiangsu provinces, the demand for aluminum carbon accounted for about 38%, the demand for negative electrodes accounted for 29%, and the demand for steel carbon. It accounts for about 22%, and other fields account for 11%. Although the current price of low-sulfur petroleum coke in the region has risen to more than 4,000 yuan/ton, the aluminum carbon sector still tops the list due to its strong support. In addition, the overall demand in the negative electrode field is good, and the price acceptability is relatively strong, with its demand accounting for as high as 29%. Since the second half of the year, the domestic steel industry’s demand for recarburizers has declined, and the electric arc furnace operating rate has basically hovered around 60%, and the support for graphite electrodes is weak. Therefore, relatively speaking, the demand for low-sulfur petroleum coke in the steel carbon field has declined significantly.

On the whole, low-sulfur petcoke production enterprises of PetroChina have been affected by the production of low-sulfur marine fuel to a certain extent, and their output has declined. At present, the low-sulfur petroleum coke indicators in Shandong and Jiangsu are relatively stable and the sulfur content is basically maintained within 0.5%, and the quality has been greatly improved compared with last year. In addition, the demand in various downstream areas will increase unabated in the future, so in the long run, the shortage of domestic low-sulfur petroleum coke resources will become normal

Post time: Sep-13-2021