In 1955, Jilin Carbon Factory, China’s first graphite electrode enterprise, was officially put into operation with the assistance of technical experts from the former Soviet Union. In the development history of graphite electrode, there are two Chinese characters.

Graphite electrode, a high temperature resistant graphite material, has excellent properties of conducting current and generating electricity, mainly used in the production of steel.

In the background of commodity general rise, this year’s graphite electrode is not idle. The average price of mainstream graphite electrode market was 21393 yuan/ton, up 51% from the same period last year. Thanks to this, the domestic graphite electrode big brother (market share of more than 20%) — Fang Da carbon (600516) in the first three quarters of this year operating income of 3.57 billion yuan, year-on-year growth of 37%, return to mother net profit growth of 118%. This dazzling achievement attracted more than 30 institutions to investigate in the last week, among which there are many large public fundraising enterprises such as Efonda and Harvest.

And the friends who pay attention to the electric power industry all know that under the iron fist of the temple energy consumption double control, high energy consumption and high pollution industries have stopped production and shutdown. Steel mills as double high enterprises must also play a leading role in hebei iron and steel province is particularly prominent. According to the truth, less steel production, the demand for graphite electrode will also decline, with toes can think of, graphite electrode prices have to drop ah.

1. Without graphite electrodes, electric arc furnaces really don’t work

For a more detailed understanding of graphite electrodes, it is necessary to open up the industrial chain for a little look. Upstream, graphite electrode to petroleum coke, needle coke two chemical products as raw materials, through 11 complex process preparation, 1 ton of graphite electrode needs 1.02 tons of raw materials, the production cycle of more than 50 days, material cost accounted for more than 65%.

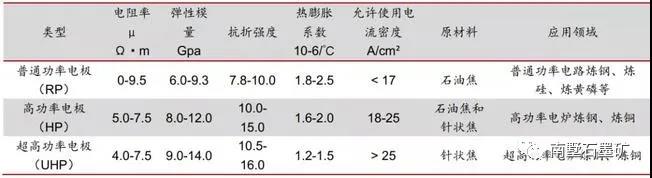

As I said, graphite electrodes conduct electricity. According to the allowable current density, graphite electrodes can be further divided into regular power, high power and ultra-high power graphite electrodes. Different kinds of electrodes have different physical and chemical properties.

Down the river, graphite electrodes are used in arc furnaces, industrial silicon and yellow phosphorus production, steel production generally accounts for about 80% of the total use of graphite electrodes, the recent price is mainly due to the steel industry. In recent years, with the increasing number of ultra-high power EAF steels with better cost performance, graphite electrodes are also developing towards ultra-high power, which has better performance than ordinary power. Who master the ultra high power graphite electrode technology, who will lead the future market. At present, the world’s top 10 manufacturers of ultra-high power graphite electrodes account for about 44.4% of the total output of ultra-high power graphite electrodes in the world. The market is relatively concentrated, and the main leading country is Japan.

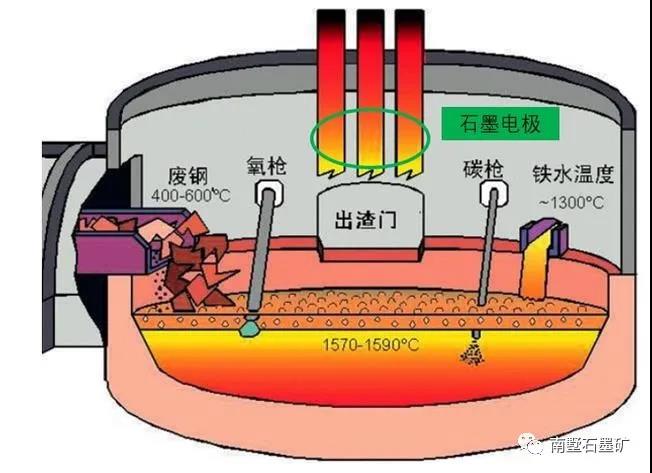

To better understand the following, here is a brief introduction of the way of making steel. Generally speaking, iron and steel smelting is divided into blast furnace and electric arc furnace: the former will be iron ore, coke and other smelting pig iron, and then a large amount of oxygen blowing converter, the molten iron decarbonization into liquid steel steelmaking. The other takes advantage of the excellent electrical and thermal properties of graphite electrodes to melt scrap steel and make it into steel.

Therefore, graphite electrode for EAF steel making, like PVDF for lithium anode, the need is not much (1 ton of steel consumes only 1.2-2.5kg graphite electrode), but it is really not possible without him. And there won’t be a replacement anytime soon.

2. Two carbon a fire, poured out the graphite electrode capacity

Not only steel, graphite electrode production is also a high energy consumption and high emissions industry, the future expansion of capacity is not optimistic. Production of one ton of graphite electrode consumes about 1.7 tons of standard coal, and if converted to 2.66 tons of carbon dioxide per ton of standard coal, a single ton of graphite electrode emits about 4.5 tons of carbon dioxide to the atmosphere. Inner Mongolia no longer approves graphite electrode project this year is a good proof.

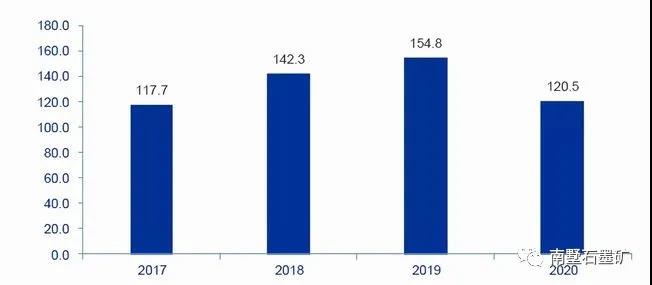

Driven by the dual carbon target and the green theme, the annual output of graphite electrodes also declined for the first time in four years. In 2017, the global eAF steel market recovery, driving the demand for graphite electrode, graphite electrode players have increased production and capacity expansion, Graphite electrode in China from 2017 to 2019 showed a high growth trend.

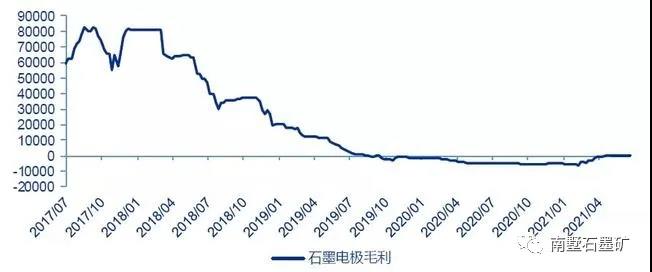

The so-called cycle, is upstream eatmeat, downstream eat noodles.

Because of the excessive investment and production of graphite electrode in the industry, resulting in too much stock in the market, opened the downward channel of the industry, inventory clearance has become the main melody. In 2020, the overall output of global graphite electrode decreased by 340,000 tons, down as high as 22%, China’s output of graphite electrode also decreased from 800,000 tons to 730,000 tons, this year’s actual output is expected to only decrease.

One night back before liberation.

Production capacity is not up, there is no money (low gross margin), raw material prices are rising. Petroleum coke, needle coke recently a week up 300-600 yuan/ton. The combination of the three leaves graphite players with only one option, which is to raise prices. Ordinary, high power, ultra-high power three graphite electrode products increased the price. According to Baichuan Yingfu report, even if the price rises, China’s graphite electrode market is still in short supply, some manufacturers almost no graphite electrode inventory, operating rate continues to climb.

3. Steel transformation, for graphite electrode open imagination space

If production limits, rising costs and unprofitability are the driving forces behind the price rise of graphite electrodes after the cycle bottomed out, the transformation of the steel industry opens up imagination for the future price rise of high-end graphite electrodes.

At present, about 90% of the domestic crude steel output comes from blast furnace steelmaking (coke), which has a large carbon emission. In recent years, with the national requirements of steel capacity transformation and upgrading, energy saving and carbon reduction, some steel manufacturers have turned from blast furnace to electric arc furnace. The relevant policies introduced last year also pointed out that the steel output of electric arc furnace accounted for more than 15% of the total crude steel output, and strive to achieve 20%. As mentioned above, because graphite electrode is very important to electric arc furnace, it also indirectly improves the quality requirements of graphite electrode.

It is not without reason that the proportion of EAF steel should be improved. Five years ago, the world electric arc furnace steel production percentage of crude steel production has reached 25.2%, the United States, the European Union 27 countries were 62.7%, 39.4%, our country in this area of progress there is a lot of space, so as to boost the graphite electrode demand.

Therefore, it can be simply estimated that if the output of EAF steel accounts for about 20% of the total output of crude steel in 2025, and the output of crude steel is calculated according to 800 million tons/year, China’s graphite electrode demand in 2025 is about 750,000 tons. Frost Sullivan predicts that at least the fourth quarter of this year still has some room to run.

It is true that the graphite electrode rises fast, all depends on the electric arc furnace belt.

4. To summarize

In conclusion, graphite electrode has strong periodic properties, and its application scenarios are relatively simple, which is greatly influenced by the downstream steel industry. After an upcycle from 2017 to 2019, it bottomed out last year. This year, under the superposition of production limit, low gross profit and high cost, the price of graphite electrode has bottomed out and the operating rate continues to rise.

In the future, with the green and low-carbon transformation requirements of the iron and steel industry, EAF steel will become an important catalyst to drive the increase of graphite electrode demand, but the transformation and upgrading will be a long process. Soaring prices for graphite electrodes may not be so simple.

Post time: Nov-08-2021