Since the second half of the year, domestic oil coke prices are rising, and foreign market prices also showed an upward trend.Due to the high demand for petroleum carbon in China’s aluminum carbon industry, the import volume of Chinese petroleum coke remained at 9 million to 1 million tons / month from July to August.But as foreign prices continue to rise, importers’ enthusiasm for high-priced resources has declined…

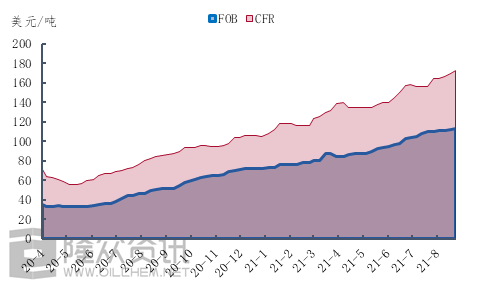

Figure 1 Price chart of high-sulfur sponge coke

Take the price of sponge coke with 6.5% sulfur, where FOB is up $8.50, from $105 per ton in the beginning of July to $113.50 in the end of August.CFR, however, rose $17 / ton, or 10.9%, from $156 / ton in early July to $173 / ton at the end of August.It can be seen that since the second half of the year, not only foreign oil and coke prices are rising, but also the pace of shipping fee prices has not stopped.Here’s a specific look at the shipping costs.

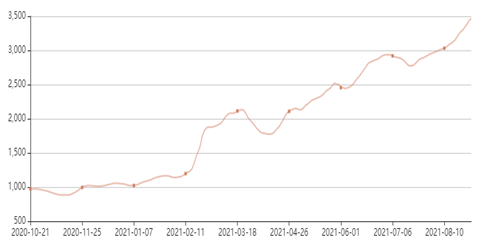

Figure 2 Change diagram of the Baltic Sea BSI freight rate index

As can be seen from Figure 2, from the change of the Baltic BSI freight rate index, since the second half of the year, the sea freight price appeared a short correction, the sea freight prices have maintained the momentum of rapid rise.By the end of August, the Baltic BSI freight rate index rose as high as 24.6%, which shows that the continuous CFR rise in the second half of the year is closely related to the rise in freight rate, and of course, the strength of demand support should not be underestimated.

Under the action of increasing freight and demand, imported oil coke is rising, even under the strong support of domestic demand, importers still appear “fear of high” sentiment.According to Longzhong Information, the total amount of oil coke imported from September to October may decline significantly.

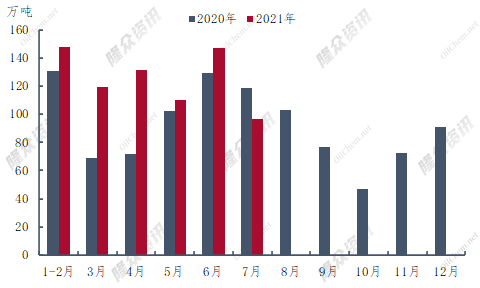

Figure 3 Comparison diagram of imported oil coke from 2020-2021

In the first half of 2021, China’s total imports of petroleum coke were 6.553,9 million tons, up 1.526,6 million tons, or 30.4% year on year.The largest import of oil coke in the first half of the year was in June, with 1.4708 million tons, up 14% year on year.China’s coke imports fell for the first year on year, down 219,600 tons from last July.According to the current shipping data, the import of oil coke could not exceed 1 million tons in August, a slightly lower from August last year.

As can be seen from Figure 3, the volume of oil coke import in September to November 2020 is in the depression of the whole year. According to Longzhong Information, the trough of oil coke import in 2021 may also appear in September to November.History is always strikingly similar, but without simple repetition.In the second half of 2020, the outbreak occurred abroad, and the production of oil coke decreased, leading to the inverted price of import coke and the reduction of import volume.In 2021, under the influence of a series of factors, the external market prices rose to a high, and the risk of imported oil coke trade continued to rise, affecting the enthusiasm of importers to order, or lead to the reduction of oil coke imports in the second half of the year.

In general, the total amount of imported oil coke will decline significantly after September compared with the first half of the year. Although the supply of domestic oil coke is expected to be further improved, the situation of tight domestic oil coke supply may continue at least until the end of October.

Post time: Sep-03-2021